Recently CEO David Wylie said that once vaccinations are well advanced and the lockdown has ended, the economy will bounce back rapidly. But the uncomfortable truth is that many jobs and companies have been lost, which will inevitably have consequences. So we decided to ask YOU what you thought and the results were interesting!

When the pandemic hit, we saw economic growth come to a standstill, and in the first few weeks we witnessed long-lasting damage being inflicted on the economy, with businesses closed, hospitality halted and travel severely affected. UK GDP was 24% lower in April 2020 than it was only two months earlier. Back then, many thought the pandemic would be over by Autumn, and the International Monetary Fund predicted the global growth to rebound to 5.8% in 2021, provided the pandemic lost momentum by the second half of 2020. This failed to happen, however, and the pandemic is still affecting our daily lives now, with the UK in its third national lockdown. At the end of the year in December, GDP was still 6% below pre-pandemic levels and the IMF estimates that across the whole of 2020 the global economy shrunk by 4.4%. They even described the decline as 'the worst since the Great Depression of the 1930s.'

This being said, there is now a light at the end of the tunnel, following the Government's roadmap to cautiously ease lockdown restrictions in England being announced in late February. With the potential for hospitality and retail to reopen in Q2, the question is: will this result in a strong bounce back of the economy, a steady, on-trend growth or has the damage already been done and are we looking at a crippling recession?

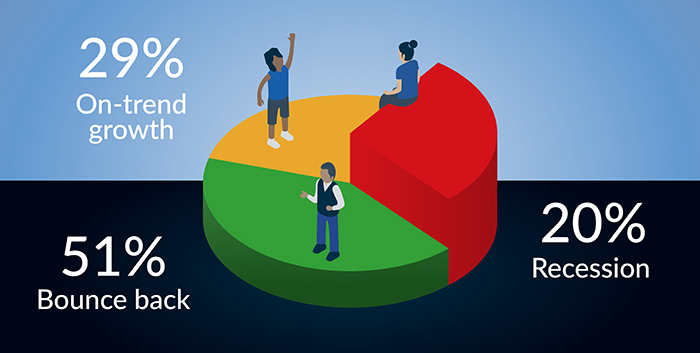

Around half of respondents (51%) agreed with CEO David Wylie's predictions, who stated that the demand bulge that lenders face will lead to a very big bounce back in the economy and lender activity. According to Mr Wylie, there is a lot of pent-up spending that will not go away, from holidays to home improvements, as people rush to make up for the many months of lockdown.

Interestingly, those who didn't vote for a strong bounce back, were largely split between on-trend growth and recession, two very different sides of the coin. 29% of respondents expect on-trend growth throughout the year, and this is reflected in the Coronavirus Economic Impact report published in the House of Commons Library, which states that the average forecast for 2021 predicts a GDP growth of 4.3%.

However, every economist currently seems to have a different opinion - some expect this pent-up consumer spending to underpin strong rapid growth, whereas others think that the rise in unemployment and job security will lead to consumers being more cautious, and that the increase we may see in spending will not be enough to save us from a recession. This echoes the concerns of the 20% of respondents who voted that they expect another recession in 2021, and those concerns are clearly relevant.

We have already seen the unpredictable nature of the pandemic, in particular when a new variant of the virus led to infection rates sky-rocketing in December, thus leading to another strict national lockdown and a longer roadmap to ease restrictions than we have seen before. This unpredictability has led to the aforementioned changing predictions, with even the NIESR - Britain's oldest independent economic research institute - first forecasting a 2021 growth of 5.9% in November and then recently making a U-turn and slashing that figure to only 3.4%.

With predictions changing as quickly as the weather, it's becoming increasingly difficult to know what to expect. What happens next, then, could depend on a variety of factors, such as whether the current roadmap is adhered to and how quickly the majority of the population are vaccinated against the virus.

The current vaccine program is already moving at an astonishing pace, with the vaccine now being offered to those aged 50 and above, or with underlying health conditions. As the Government aims to offer the vaccine to everyone in priority groups 5-9 by the 15th of April, if this goal is met we can surely expect the current restrictions to be lifted as planned and a gradual return to normality.

Mr Wylie predicts that this could be likely by June or July, and, as a result, demand for credit will be particularly strong for point-of-sale and specialist finance, as consumers rush to book holidays and rapidly re-start the spending that they put on hold during the pandemic. However, some credit providers may not be ready for the huge upsurge in applications that this will bring, and in preparation should be testing their existing systems to ensure they can contend with the sudden boost in spending.

One way for lenders to brace themselves for this upsurge is to look into automating their credit decisions, and utilising initiatives such as Open Banking to precisely see what customers earn and spend, in real time. The ability to paint an accurate affordability picture quickly will be essential in lenders dealing with the expected increase in applications. Without such platforms in place ahead of the boost in consumer spending, lenders risk either turning away too many relevant applications, or adopting a "yes to all" attitude, which could be equally as damaging in the long run.

LendingMetrics provides both automated decisioning technology and Open Banking software, as well as free consultations for lenders to ensure they are best prepared for the predicted spending spree. To find out more, book an exploratory call with us today.